Overview of the paper-making industry chain, paper pulp classification, degradable material paper pulp ,bamboo pulp

Paper Pulp Study (I)

1. Overview of the paper-making industry chain:

Papermaking industry chain from the source of raw materials is wood, other alternative wood raw materials and waste paper, to the upstream pulp is corresponding wood pulp, wood pulp and waste pulp, these categories and can fine classification, including needle pulp, hardwood pulp, chemical pulp, mechanical pulp (different way), bleaching pulp, half bleaching pulp and not bleaching pulp (of different appearance), etc., in detail below. The direction of different pulp and paper is also not the same, the paper can be divided into white paper, double adhesive paper, household paper, special paper, corrugated paper, box paper and so on, these paper for different uses. It should be noted here that the delivery spot corresponding to the previous pulp futures is bleached sulfate needle wood pulp.

Source: Deppon Securities Research Institute

2. Classification of paper pulp

1. Classification according to the raw materials

Raw materials determine the properties of paper, the production of paper can be single or in proportion (due to the different cost, the proportion of broad-leaved pulp will increase). According to the raw materials, the paper pulp can be divided into wood pulp, non-wood pulp and waste paper pulp, among which the wood pulp can be divided into coniferous pulp and broad-leaf pulp according to the tree species.

Conifers mostly grow in middle and high latitudes, such as North America, Northern Europe, Russia, Chile and other regions. There are about 840 kinds of conifers worldwide, mainly trees or shrubs. Leaves are like needles, evergreen, and leaves will not fall in winter. Most conifer species have slow growth, long growth cycle (20-25 years), good paper flexibility, good tensile strength, and good printing performance.

Broad-leaved trees are mostly broad and broad, mostly growing in the middle and low latitudes, such as the southern United States, Brazil, Chile and Indonesia, with a short growth cycle (3-5 years), high paper pine thickness, shallow creases, and good packaging performance.

It should also be emphasized here that the difference between coniferous pulp and broad-leaved pulp is not only different in the latitude and elevation of the raw material, but also includes:

·

The production capacity of coniferous wood is relatively scattered, and the production capacity of broad-leaved wood is relatively concentrated to form a monopoly, which is why the coniferous pulp is chosen as the delivery target.

·

·

Cost difference: In general, the high lignin content of conifers requires more alkaline substances to dissolve, the low cellulose content (low pulp rate), the pulp cost is higher, the needle pulp is more expensive, the broad-leaved pulp is cheaper, the cheapest broad-leaved pulp cost is in Brazil, about 200 dollars.

·

·

The difference in the performance of wood chips leads to the different final use, the needle wood fiber strength and length is higher, and the broad-leaved wood fiber adhesion is higher, so the addition of needle pulp can make the paper more resistant to folding, tensile, the addition of broad leaf pulp can enhance the stability of the paper, not easy to curl.

·

The wood raw materials in our country can be traced back to very far, Cai Lun paper with is the wood raw materials (bark fiber, waste fishing nets, hemp, etc.), the song dynasty bamboo (bamboo pulp) paper is also very popular, and here there is a small knowledge is learning power, when making paper to add star fruit cane juice pulp, can increase the pulp viscosity at the same time also can make the pulp fiber distribution evenly, (knowledge to form a closed loop here...)

The third type of raw material source of paper pulp is waste paper. Waste paper is the largest source of fiber in China's paper industry. In 2021, the "ban on waste" implementation, the import of waste paper decreased more.

2. Classification according to the production method

The production methods mainly include chemical, semichemical, mechanical and chemical methods, with the aim to remove lignin and retain cellulose and hemicellulose. Chemical method is the use of chemicals to decompose the cellulose in wood, such as sulfate, to obtain sulfate wood pulp (currently mainly bleached sulfate pulp), or sulfite pulp. At present, the mainstream of the world still takes chemical method as the main process, accounting for more than 70%, and the yield of paper pulp obtained by chemical method accounts for about 50%, and the chemical pulp fiber is relatively complete, mainly used for printing paper manufacturing. Bleached sulfuric acid pulp (BHKP) is divided into northern bleached broad-leaved pulp, southern bleached broad-leaved pulp (cultural paper) and bleached eucalyptus pulp (toilet paper), bleached conifer pulp is divided into northern bleached conifer pulp, southern bleached conifer pulp (fluff pulp, paper towel). Chemical and mechanical method is to use chemical substances to treat the wood first, and then use machinery to separate the wood fiber. This method accounts for about 10% of the production capacity, and the pulp yield is as high as 90%, which is mostly used for cardboard production. In addition, pure mechanical pulp accounted for 15%, the highest yield, mainly used for the production of newspapers.

3. Paper pulp production capacity distribution and supply structure

1. According to the domestic and overseas markets:

Overseas: According to the research report of CICC, the global wood pulp production capacity is about 180 million tons, and the trade of wood pulp accounts for less than 40%. Since 2000, the global annual paper pulp capacity has stabilized at about 180 million tons. According to FAO data, the largest global paper pulp output is the United States. As of 2022, the US paper pulp capacity is 49.2 million tons, including 9.52 million tons; followed by Brazil, with 24.77 million tons of paper pulp capacity, including 19.2 million tons, which is expected to increase by 2 million tons in 2023. Most of the global pulp is supplied by paper mills, and the global trade pulp accounts for only about 35%, and the floating pulp / needle pulp accounts for 58% / 39% of the trade pulp demand respectively. Therefore, the global pulp price trend mainly depends on the supply and demand side of this part of the trade pulp.

Domestic: first of all, it needs to be clear that the import dependence of Chinese wood pulp is relatively high. Due to the limited wood resources that can be used for the production of pulp, the expansion of midstream paper production capacity leads to our high dependence on pulp import. At the same time, part of domestic wood pulp originally comes from imported wood chips. According to the statistics of the agency, imported pulp accounts for about 60% of the total wood pulp consumption. With the control of the import of waste products, the proportion of domestic wood pulp has increased significantly, and it is divided into market with imported pulp. Note: Imported wood chips produce one ton of wood pulp per 2.5 cubic meters. In terms of domestic production, the national pulp output is nearly 20 million tons, mainly concentrated in Shandong and Guangxi regions, and the bamboo pulp is mainly concentrated in Sichuan.

Source: Great Wall Securities, Baichuan Yingfeng Fu

In terms of domestic imports, the American continent is the main import source of wood pulp, mainly from Brazil, Indonesia, Thailand, Canada, USA, where Brazil (27%) and Indonesia have the largest proportion; and the largest import source of wood chips is distributed in Southeast Asia, mainly Vietnam, accounting for 56% of the imports, followed by Australia, Thailand, Chile and Brazil.

According to the statistics of Baichuan Yingfeng, the global wood pulp production capacity increased by more than 5.45 million tons in 2023, and 2024-25 is still a big year for production, which is expected to increase by 1.85 million tons and 5.55 million tons respectively.

2. Ranked according to the market share of needle pulp and broad-leaved pulp

Broad commodity pulp capacity concentration is high, Brazil production capacity is the first, far exceeding the total capacity of the United States, Canada, Russia and China, strong monopoly. The capacity of drift needle is scattered, with the largest in the United States, followed by Canada and Russia.

According to the ranking of needle pulp market share, it is mainly concentrated in the following enterprises: International Paper, Koch Ind, Metsa, Mercer, Domtar, Arauco, Sodra, Paper Excellence, IIim, Stora Enso, etc. International Paper It is the largest paper company. Stora Enso, Located in Helsinki, Finland. Stora Enso is the world's leading supplier of renewable solutions for packaging, biomaterials, wood construction and paper for the global market. IIim is a privately owned, listed Hong Kong paper company with paper mills in Chinese mainland and Vietnam.

According to the ranking of broad-leaved pulp, it is mainly concentrated in the following enterprises: Suzano, Eldorado + APP, CMPC, April, Arauco, UPM, Cenibra, Klabin, Ence, Altri, etc. Based in Helsinki, Finland, UPM specializes in the production and sale of magazine paper, newsprint, fine and specialty paper. Suzano Located in Brazil, it is the largest producer of broad-leaved pulp, with 1.4 million tons of paper production capacity and 10.9 million tons of pulp production capacity, relying on port transport or train transport.

According to statistics, the current new production capacity is mostly broad-leaved pulp production capacity.

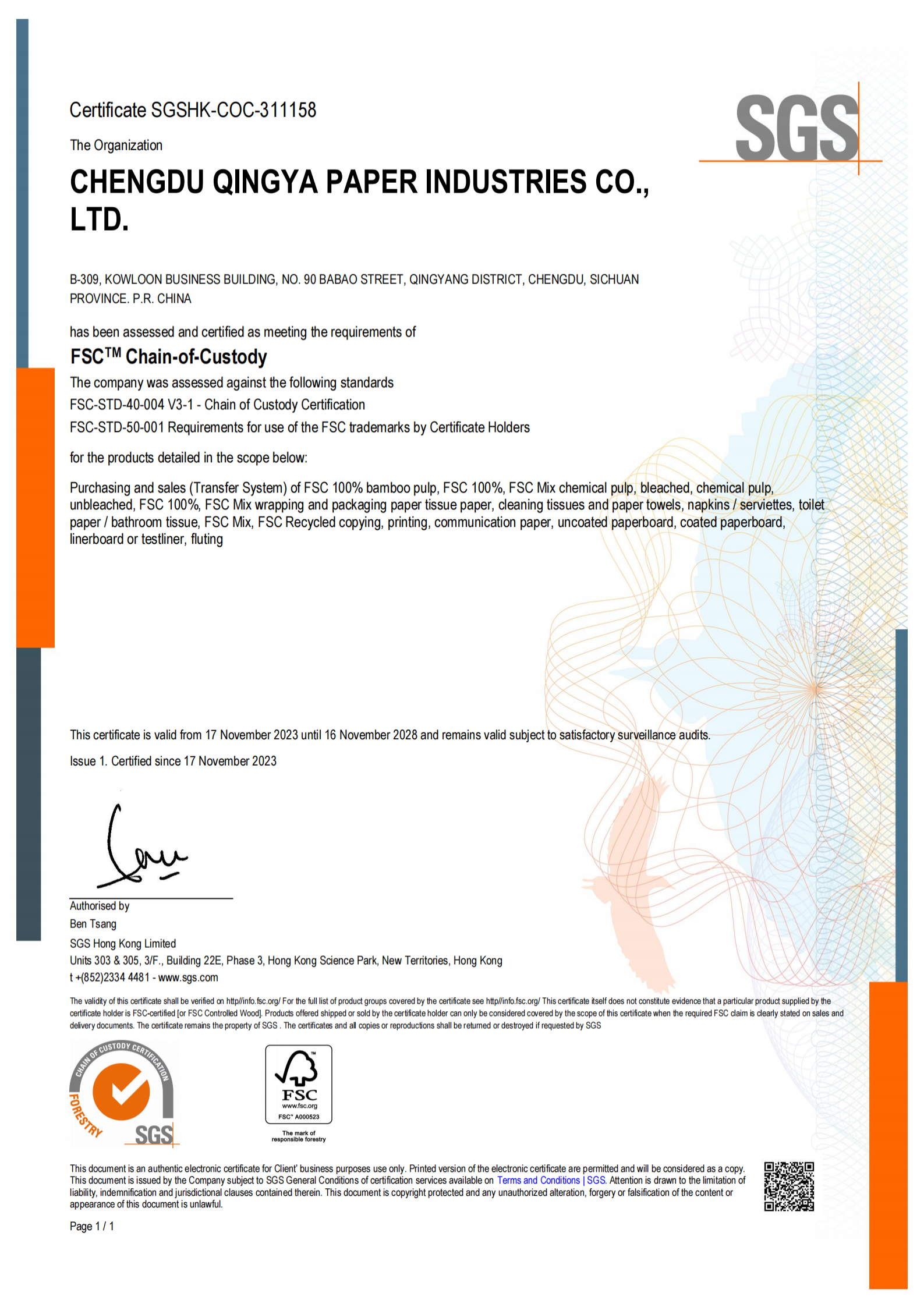

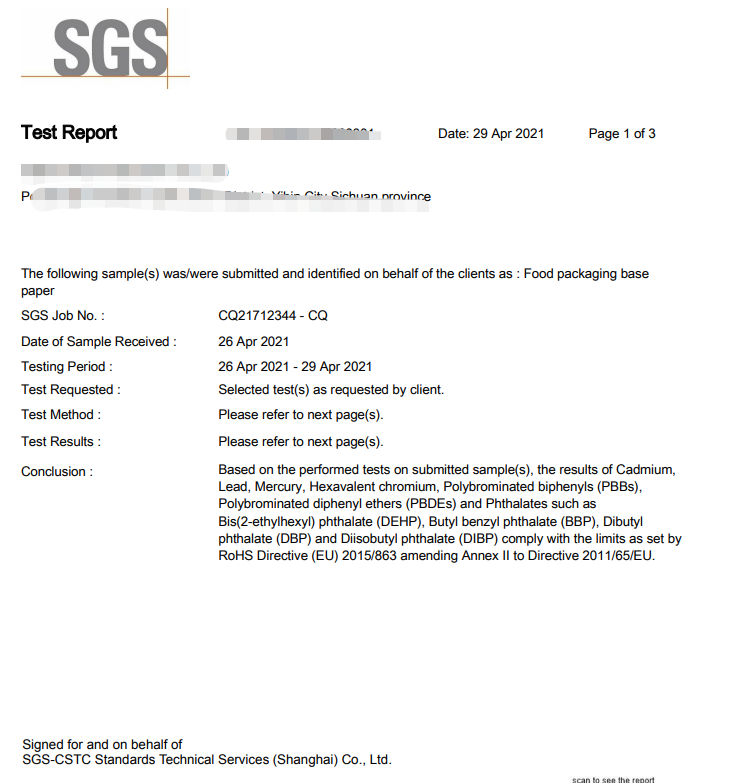

We are committed to bamboo products, which are more environmentally friendly than wood products.

We are served for customers from more than 30 countries.

We accept custom requirements and provide OEM products.

We have focused on bamboo pulp paper for 20 years.

Take advantage of our unrivaled knowledge and experience, we offer you the best customization service.

Get in touch

OEM custom solutions, we have focused on tissue production for 14 years